Finding the Best Payroll Management Software in India is a game changer for businesses irrespective of their size & niche. However, most business people have a myth that investors alone can take their business to the peak. Catching the interest of multiple investors for small and medium-sized enterprises (SMEs) is a step towards overall business growth. Yet, with the development of the business, handling the logistics part has become chaotic and messy. Here is when the Best Payroll Software in India comes to your rescue. It takes away a lot of manual effort by HR and payroll professionals, such as salary disbursement, payslip generation, tax calculation, etc. According to the source, India’s payroll software and Human resources management system (HRMS) market has been forecasted to expand at the rate of 26.16% CAGR till the end of 2029. According to this source, the global market of payroll software services has been predicted to grow at a rate of 3.2% CAGR by 2028. It comes to around $80.97 billion. The primary reasons behind this sudden growth are:

- Unmanageable complexities in manual payroll processing.

- Increasing globalization.

- The development of small and medium enterprises (SMEs).

In this blog, let’s learn more about payroll software and its benefits, features, and importance.

What is Payroll software?

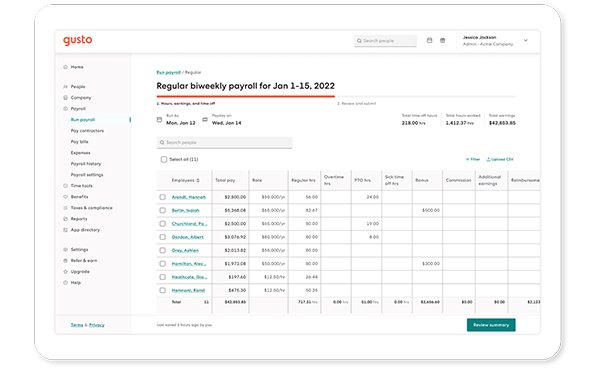

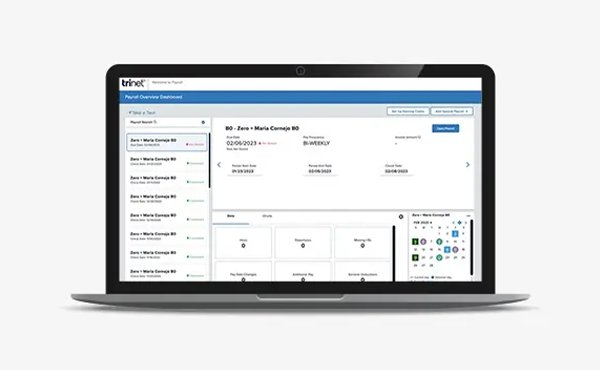

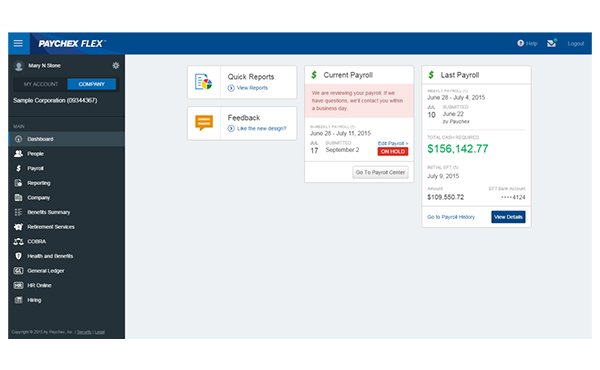

Payroll software is either a cloud-based or an on-premises software application that automates, handles and organizes employee payment. With the help of effective payroll management software, companies get cost-effective solutions, less manual load, and 50x speed up everyday payroll tasks. The time saved by HR professionals can be further focused on planning, budgeting, and other critical areas of the company. On the other hand, employees can easily access their crucial payments & benefit-related information through the software itself. According to the source, ‘TOI Business,’ INR 5000/- penalty is charged to the company for not filing ITR (Income Tax Returns) on time as it has become mandatory under section 139, subsection (1) of the Income Tax Act. On the whole, organizations of different sizes use payroll software to help them adhere to financial regulations and ensure compliance with tax laws.

Benefits of Payroll systems

The payroll system has several benefits in every type of business today, such as error-free data, accuracy, compliance with laws, etc. Here, we have mentioned a detailed overview of the benefits of a payroll management system:

Effective Time Management: Manual payroll processing is a huge time eater, leading to inefficiency and errors in the system. With the proper payroll system, you can save time for HR, payroll, and other finance professionals. The payroll software effectively manages time as 90% of the tasks, such as tax calculation and salary distribution, get automated.

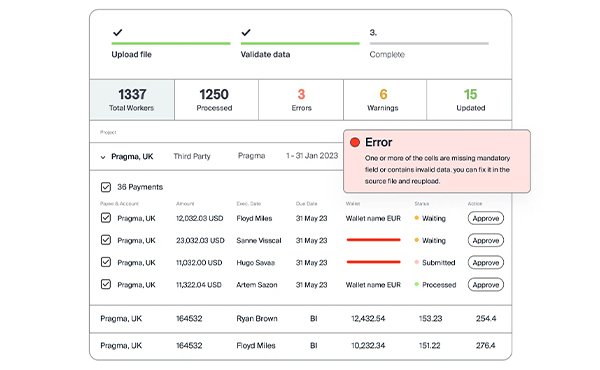

Optimised Data Security: The payroll data comprises employees’ sensitive information such as their bank card numbers, salary details, addresses, social security numbers, bars, etc. Such data is prone to attacks from third parties. Effective payroll software ensures that payroll data is 100% safe & encrypted and allows only confidential access with multi-factor authorization.

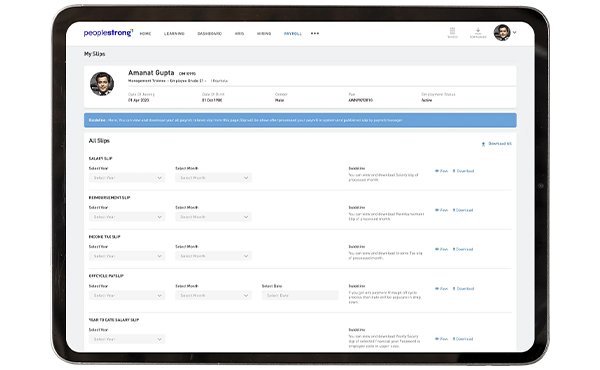

Employee Self-Service: In manual payroll processing, employees must coordinate with payroll admins to access their payroll information. It wasted the time of payroll professionals & caused a huge communication gap between employees & employers. Thanks to the payroll software that provides instant access to self-service portals. Employees can view their payroll data, such as tax forms, pay slips, w-2 forms, and other information, without coordinating with payroll professionals.

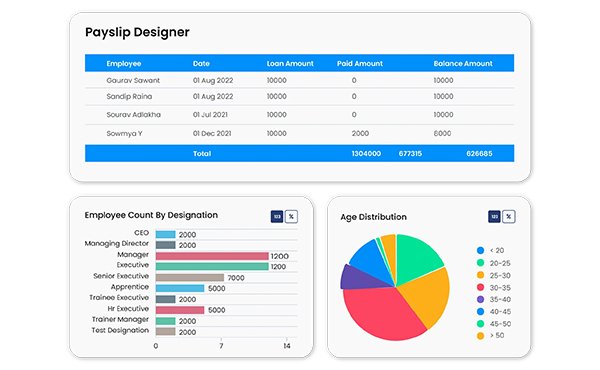

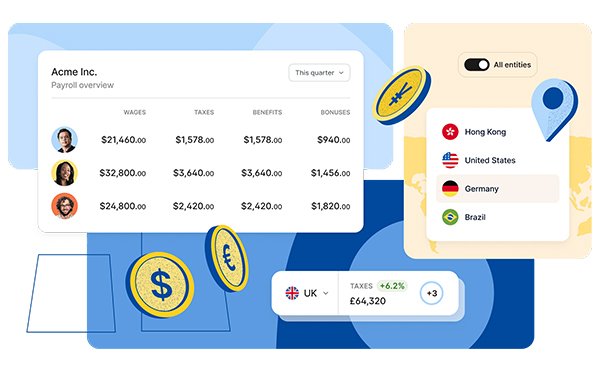

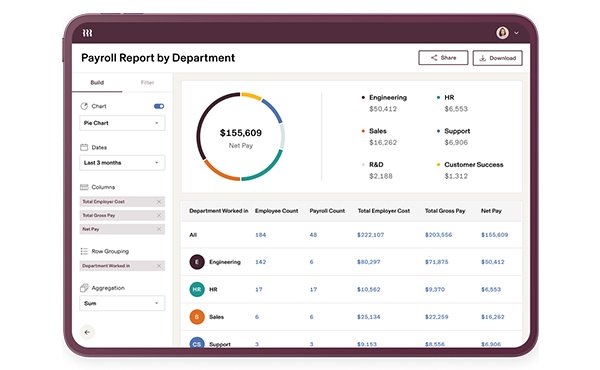

Real-Time Analytics: The best payroll software in India provides real-time analytics & insights and helps generate various types of reports. It allows managers to track employee payments wisely, view accurate time & attendance records, etc. Through this benefit, employers can generate multiple reports on productivity, labor cost, and ongoing payroll trends & patterns. It improves decision-making & allows businesses to prepare for future payroll-related risks beforehand financially.

Enhanced Efficiency and Accuracy: Processing payroll activities in the traditional ways creates errors leading to inaccurate & inefficient outcomes. Such mistakes in tax deductions, salary calculation, data entry, etc, are removed by an HR payroll software due to minimal human intervention.

Compliance with State Laws: Manual handling of payroll data led to legal obligations & heavy penalties due to improper calculation, late tax filing, and non-adherence to the recent tax laws. Payroll software insurance complies with the newest laws regarding state, labor, and tax regulations.

Feature of Payroll software

Payroll software has various features such as integration, compensation management, tax filing, customization, etc. Below are the features of payroll software:

Compensation Management: Providing the proper pay, regular benefits, and compensation to deserving employees needed to catch up in the manual payroll processing. The top payroll systems solve such problems with the latest compensation management tools. With the help of these tools, employers can smoothly allocate and manage the entire budget allocation process. Such a feature ensures competitive pay, additional bonuses, and other rewards to the most deserving candidate, resulting in employee retention.

Personalized Customization: Different businesses have different payroll requirements. Therefore, payroll software offers personalized customization in its uniquely designed system for every business. This means you can add or modify specific features based on the number of employees and current business needs.

System Applications Integration: Manual payroll processing required physical coordination with different departments and was time-consuming. The payroll software solved this problem by integrating different platforms, such as time & attendance tracking, account management, leave management, etc., at one central location. It increases the efficiency, accuracy, and productivity of the company and the employees.

Tax filing: Manually staying updated with the regular changes in tax laws is nearly impossible. Payroll software comes to the rescue by automatically updating all the changes in the tax rates and related labor laws. Due to this, your tax filing process becomes simple, and ample time is saved that was previously wasted on calculating deductions.

Expense Management: Tracking every reimbursement manually is a difficult task. Therefore, the best payroll system in India is integrated with expense management to simplify the entire process. It keeps track of every reimbursement-related record on its central automated platform, such as lodging expenses, recharge bills, travel expenses, etc. This further makes it easier to retrieve the expense reports whenever needed.

Direct Deposit: Safety-related issues occur more often in manual payroll processing, which causes employees to run back to the payroll administrators. The automatic payroll software solved this issue through a direct deposit feature that instantly generates payslips whenever salary is disbursed in the employees’ bank accounts. It helps employees to view their overall taxes and other payroll-related deductions from their wages.

Exploring the Role of HR Payroll Management Systems

In the manual payroll processing, 49% of employees started looking for new job roles after not getting paid on time, as per the source ‘The workforce institution of Kronos.’ Thus, the increased employee turnover rate highlighted the role of HR payroll management systems. Handling employee details and salaries manually has always been chaotic, regardless of company size. Therefore, the HR department and payroll department work closely hand in hand, and this integration has been possible through the HR payroll management system. The role of HR payroll management software is to streamline, simplify, and automate all the HR & payroll tasks. It calculates and releases employees’ salaries automatically in their respective bank accounts. Moreover, it takes care of the loans, payment slip generation, allowances, exact deductions, bonuses, encashment of leaves, & net payable amount to the employees. As a result, the overall performance of the system gets optimized with minimal scope of errors due to reduced human intervention.

How can Best Payroll software help small Business in India?

Payroll software can offer several benefits to small and medium-sized businesses (SMBs), addressing various needs and challenges they face:

Automation of Payroll Processes

Payroll software automates the calculation of wages, salaries, bonuses, taxes, and deductions based on predefined rules. This reduces manual errors and ensures timely payments.

Time Savings

Automating payroll processes saves significant time compared to manual calculations and paperwork. It allows HR and payroll teams to focus on strategic tasks rather than administrative duties.

Accuracy and Compliance

Payroll software helps ensure accuracy in payroll calculations and compliance with tax laws, labor regulations, and reporting requirements. This reduces the risk of penalties and legal issues.

Direct Deposit and Payment Options

Many payroll software solutions offer direct deposit capabilities, enabling businesses to pay employees electronically. This is convenient for both employers and employees, eliminating the need for physical checks.

Employee Self-Service

Employees can access their payroll information, such as pay stubs and tax forms, through self-service portals. This reduces the administrative burden on HR and empowers employees to manage their information.

Integration with Other Systems

Payroll software often integrates with other HR systems, accounting software, time-tracking tools, and benefits administration platforms. This seamless integration improves data accuracy and eliminates redundant data entry.

Reporting and Analytics

Payroll software provides comprehensive reporting capabilities, allowing businesses to generate various payroll reports, analyze payroll data trends, and gain insights into labor costs and workforce analytics.

Data Security

Payroll software enhances data security by storing sensitive payroll information securely, adhering to industry standards and regulations. This protects employee data from unauthorized access and breaches.

Scalability

Payroll software is scalable, accommodating business growth and changes in workforce size. Whether adding new employees, locations, or payroll complexities, the software can adjust to meet evolving needs.

Cost Savings

While there is an initial investment in payroll software, it often results in cost savings over time. It reduces labor costs associated with manual payroll processing, minimizes compliance risks, and optimizes operational efficiency.

Top 10 Payroll Software in India

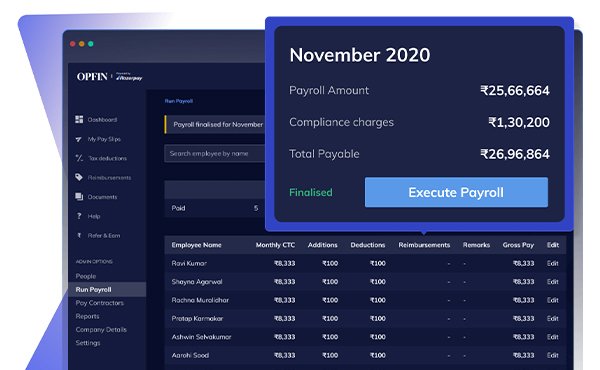

Zimyo Payroll Software

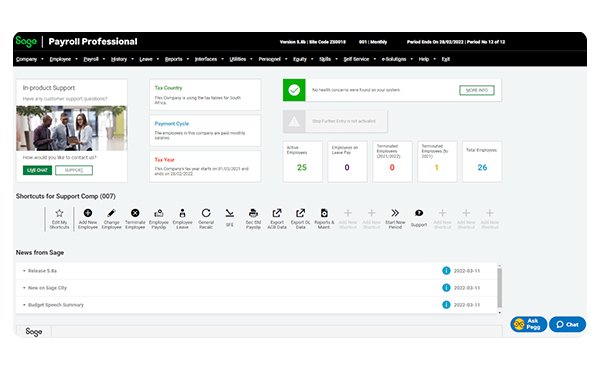

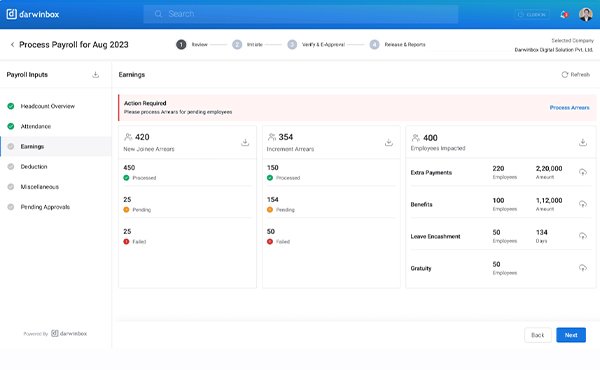

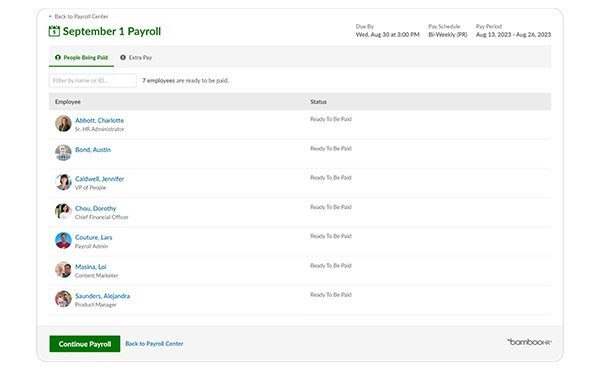

Zimyo is the Best Payroll Software provider in India with a robust solution designed to simplify HR and payroll management for businesses. It automates payroll calculations, tax deductions, and compliance tasks while offering employee self-service features like leave management and expense claims. With intuitive interfaces for both administrators and employees, Zimyo enhances efficiency by centralizing HR processes and ensuring accurate payroll processing.

Price: Starting at INR 25,000 annually

Rating: 4.5/5

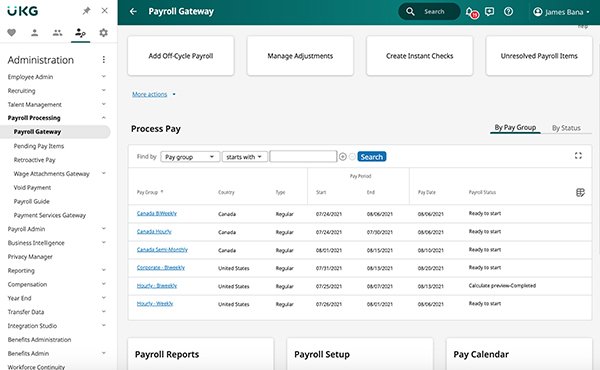

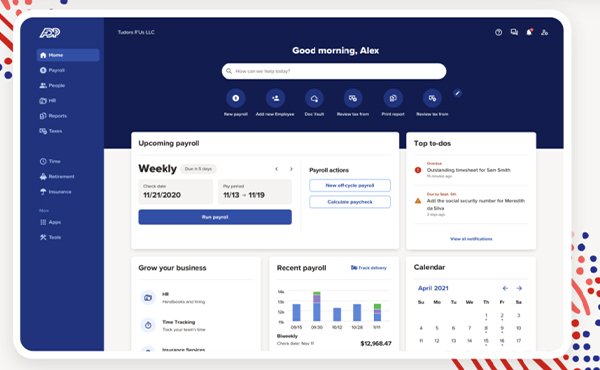

Zoho Payroll Software

Zoho Payroll Software is a user-friendly platform designed to streamline payroll processing for small to medium-sized businesses. It offers automated payroll calculations, tax filing, and compliance management to ensure accurate and timely payments. Zoho Payroll integrates seamlessly with other Zoho applications, allowing for easy access to employee data and financial records. It also features employee self-service options for leave management, expense claims, and accessing payslips. With its intuitive interface and comprehensive features, Zoho Payroll simplifies HR operations and enhances organizational efficiency.

Price: Starting at INR 9,000 annually

Rating: 4.4/5

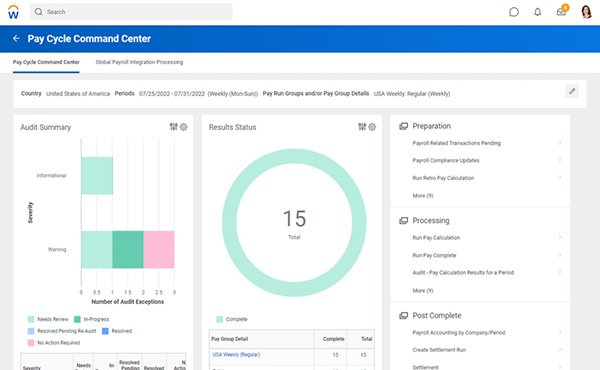

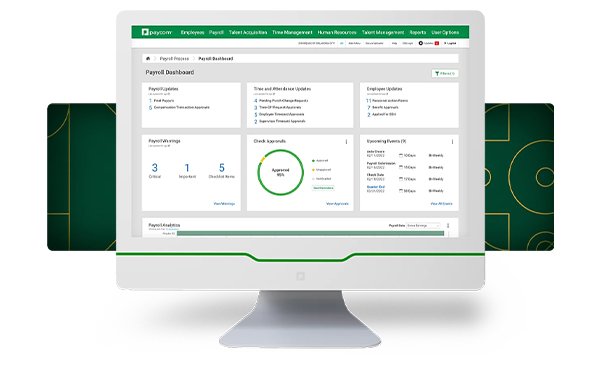

greytHR Payroll Software

greytHR is the Best HR and Payroll Software in India with a versatile tool tailored for Indian businesses, offering comprehensive HR and payroll management solutions. It automates payroll processes, including salary calculations, tax deductions, and statutory compliance, ensuring accuracy and efficiency. greytHR facilitates employee self-service with features for leave management, expense claims, and attendance tracking, empowering employees while reducing administrative burden. The software integrates seamlessly with other HR systems and provides real-time insights through customizable reports and analytics. With its user-friendly interface and robust capabilities, greytHR enables businesses to streamline operations and focus on strategic initiatives.

Price: Starting at INR 8,000 annually

Rating: 4.3/5

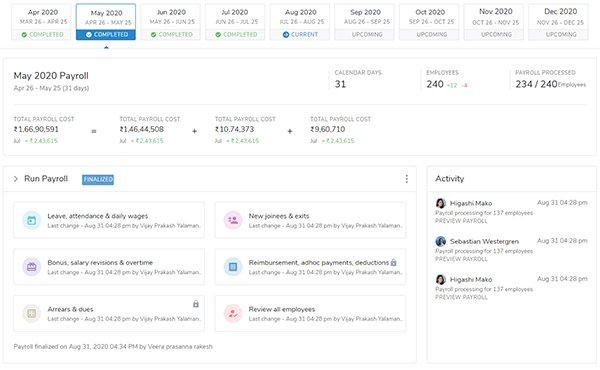

Qandle Payroll Software

Qandle Payroll Software is a modern HR and payroll management solution designed for businesses looking to streamline their administrative processes. It offers automated payroll processing, including calculations for salaries, taxes, and deductions, ensuring compliance with local regulations. Qandle features intuitive self-service portals for employees to manage their leave requests and expense claims and access pay slips conveniently. The software provides real-time analytics and reporting tools to help businesses gain insights into their workforce data and make informed decisions. With its user-friendly interface and scalable features, Qandle enhances operational efficiency and empowers HR teams to focus on strategic initiatives.

Price: Starting at INR 15,000 annually

Rating: 4.2/5

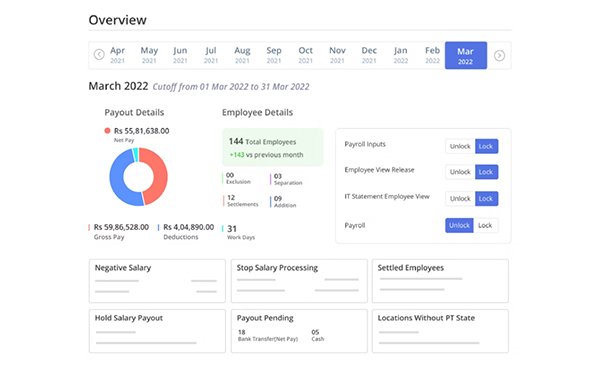

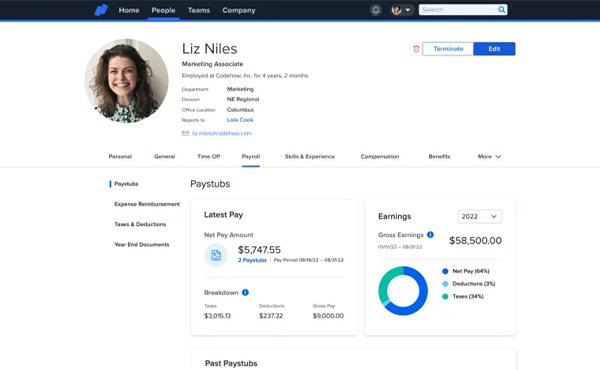

HROne Payroll Software

HROne Payroll Software is a comprehensive solution designed to simplify HR and payroll management for businesses. It automates payroll processes such as salary calculations, tax deductions, and compliance with local regulations, ensuring accuracy and efficiency. HROne offers employee self-service features for leave management, expense claims, and accessing payslips, thereby reducing administrative workload. The software integrates seamlessly with other HR systems. It provides customizable reports and analytics to track and analyze employee data effectively. With its user-friendly interface and robust functionalities, HROne Payroll Software helps organizations streamline operations and improve overall HR management.

Price: Starting at INR 20,000 annually

Rating: 4.1/5

Pocket HRMS Payroll Software

Pocket HRMS Payroll Software is a versatile tool designed to streamline HR and payroll processes for businesses of all sizes. It offers comprehensive payroll management capabilities, automating tasks such as salary calculations, tax deductions, and compliance with local regulations. Pocket HRMS features employee self-service portals for leave management, expense claims, and accessing payslips, empowering employees and reducing administrative workload. The software integrates smoothly with other HR systems and provides real-time insights through customizable reports and analytics. With its user-friendly interface and scalable features, Pocket HRMS enhances operational efficiency and supports strategic HR management decisions.

Price: Starting at INR 18,000 annually

Rating: 4.0/5

Importance of Payroll management software

The HR payroll software holds a special place in the Human Resource Industry. Companies suffered big-time losses while handling payroll tasks manually. With the maximized manual human intervention, there was a significant delay in the salary distribution process. The disbursed salaries needed to be more accurate, leading to employee dissatisfaction & early withdrawal from their work. This caused disputes between employee-employee and employer-employee, leading to legal issues due to non-compliance with tax regulations. According to the source ‘Clutch,’ the count of small businesses that work on the traditional payroll systems, i.e., through papers, pens, and registers, is 25%. The worst part is that 45% of small businesses must hire a bookkeeper or a payroll accountant, even while handling payroll operations manually. These stats are alarming.

Therefore, having effective cloud payroll software is the need of the hour to ensure correct salary disbursement, accurate tax calculation, compliance with Payroll laws, and high-end productivity. The best part is that small to medium enterprises working hard for growth can save a vast amount of money on hiring payroll professionals for tax calculation or salary distribution. The best payroll software offers cost-effective solutions through its cloud-based, integrated, and automated platform, minimizing the need for payroll administrators.

Best payroll software for small businesses in India

Hundreds of Best payroll software for small businesses in India have unique capabilities and offerings. Some of the most popular cloud payroll software are Keka, HR One, Darwinbox, etc. With top-notch ratings and years of excellence, keka hr payroll software stands ahead of others, especially for small and medium enterprises (SMEs). It offers 360° HR payroll software solutions from timely salary distribution to accurate calculation of taxes. It seamlessly integrates with other platforms for hassle-free operations. On the whole, the best payroll software is the one that efficiently handles all the complex payroll processes with utmost precision and reduces human intervention. These payroll tasks include developing payroll policies, creating CTC structures, calculating tax-related deductions, and dues deposits such as PF, ESCI, etc.

The List of payroll software in India for small businesses is enormous; subsequently, you need to be mindful of it before finalizing it. We have your back if you are looking for paid or free payroll software for small businesses in India. StartUpHR software connects you to India’s most relevant attendance and payroll software solution vendor without breaking your budget. However, with the significant revisions in your existing budget, you can avail of the most trending payroll features.

How do you choose the best payroll software in India?

Choosing the best payroll software is essential for overall business growth. Different HR payroll software has different capabilities, so every software might not fit your business needs. Therefore, we have curated some crucial points for you that you should keep in mind while choosing the best software in India:

Get clarity on the following questions.

- Short-term and long-term goals concerning the HR payroll software.

- Does the payroll software need to be integrated with other applications such as attendance tracking, time management, etc?

- Will my company’s size increase in the next five years, and if so, by what percentage or number?

- What is my maximum budget for purchasing payroll software?

- Ask the payroll vendor about all the hidden charges.

- I prefer to conduct in-depth research on payroll vendors from online sites such as Glassdoor. Check for their reviews, reputation, and prior records.

- Does the payroll software vendor provide after-sales support?

State your short-term and long-term goals: Once you have decided who your payroll software vendor will be, you need to define the goals and targets. Create an in-depth layout stating all the crucial steps for the smooth implementation of the software. Mention the date, time, resources, and the exact timeline for the software implementation. Also, consider all the potential obstacles that might distract you from achieving your targets. Work in collaboration with a payroll vendor. Let him review the entire layout design you provided and ask for his feedback on any inconsistencies in the specified timeline. Make the necessary changes accordingly.

Develop the implementation plan: Schedule a board meeting with all the company’s essential decision-makers. Discuss the payroll software, its features, and its implementation plan. Take feedback from every member and assign the designated task to the respective members accordingly. Also, discuss the total number of hours that would be devoted to this project each day and the total estimated time that would be taken for the implementation of this project.

Conduct training sessions for employees: Employees should be provided with information on using the payroll software as they are new to the system. The following sessions should be conducted with the employees:

- A typical training with all the employees in batches describing all the different functions of payroll software available and how to operate them.

- A detailed session of the employees with the payroll vendor addressing the importance of payroll software, its available features, and how to make the most out of it.

- Record all the latest processes in the payroll software so that employees can work on them without seeking help from the payroll professionals.

- Create detailed reports so employees can effortlessly and effectively use the data in the payroll system.

Quality Check: Quality assurance is an integral part of every software for its overall success. Neglecting software quality leads to huge errors after its execution that further hinder the productivity and quality of its operations. Before going live with your payroll software, ensure that the quality of the payroll software is up to the mark. Check for potential errors and rectify them before executing the software. Moreover, the company should take feedback from the employees working on the software after a few days; if they face any issues, then simplify the process by contacting the payroll vendor.

Go live: Once everything is ready, you can go live with payroll software. Evaluate the system, functionalities, speed, ease of the platform excess, etc, for a few weeks. If you encounter any problem, contact your payroll vendor immediately and get it rectified as soon as possible.

Conclusion

Payroll software is no longer an advancement tool but a necessity to handle employees’ salaries & taxes accurately. Therefore, more and more payroll software vendors are capturing the market today. Searching for the best payroll software vendor in India might be overwhelming. If you are browsing through the vast List of payroll software in India and feeling stuck, no worries; we are here to help you. While conducting this in-depth research, you might pick up the wrong payroll software. Here is when StartupHR software comes as a backbone support by connecting you to the right payroll software provider. Although we have covered India’s Top 10 payroll software in this blog, we urge you to take the Free Consultation with our HR experts to get personalized solutions. Once we understand your business requirements, we will curate the best payroll software in India and show you the live demonstration through our FREE OF COST Demo Session.

F.A.Q

1. What is payroll software, and why do businesses use it?

Payroll software automates the process of calculating payments to employees, handling deductions and taxes, and generating reports. Businesses use it to streamline payroll operations, reduce errors, and ensure compliance with tax laws and regulations.

2. How do I choose the right payroll software for my business?

Consider factors such as the size of your business, your industry-specific needs, integration capabilities with other software (like accounting or HR systems), ease of use, customer support, and cost.

3. What are the key features I should look for in payroll software?

Key features include automated payroll calculations, tax filing and compliance, direct deposit options, employee self-service portals, reporting and analytics, mobile accessibility, and integration with other business systems.

4. Can payroll software handle different types of employee compensation?

Yes, most payroll software can handle various types of employee compensation, including salaries, hourly wages, bonuses, commissions, benefits, reimbursements, and deductions for taxes and benefits.

5. How does payroll software ensure compliance with tax laws and regulations?

Payroll software automatically calculates taxes based on current tax rates and laws, prepares tax forms (like W-2s in the U.S.), and facilitates electronic filing and payments to tax authorities. Regular updates keep the software compliant with changing regulations.

6. Is payroll software secure?

Yes, reputable payroll software providers use encryption and secure servers to protect sensitive payroll data. They also adhere to industry standards and regulations to ensure data security and confidentiality.

7. Can payroll software integrate with other business systems?

Yes, many payroll software solutions offer integration with accounting software, HR management systems, time and attendance tracking systems, and more. Integration helps streamline processes and reduces manual data entry.

8. How does payroll software handle employee benefits and deductions?

Payroll software allows you to set up and manage employee benefits such as retirement plans, health insurance, and deductions like taxes, garnishments, and voluntary contributions. It calculates these amounts accurately and includes them in payroll calculations.

9. What kind of customer support is available with payroll software?

Customer support options vary by provider but typically include phone, email, and online chat support during business hours. Some providers may also offer 24/7 support for critical issues.

10. How much does payroll software cost?

The cost of payroll software can vary widely depending on the features, number of employees, and additional services like tax filing and HR support. Pricing models may include monthly subscriptions or per-employee fees. It’s essential to consider the total cost of ownership, including setup fees, training, and support.

Top Features

Top Features

Top Features

Top Features Top Features

Top Features